Stamp Duty in Wales

- jasonrg1970

- Oct 28, 2020

- 2 min read

1.Stamp Duty Wales

When you buy property or land in the UK, you have pay tax depending on many variables. Generically the term “stamp duty” is used for such tax but in fact this term is now only used for the relevant tax in England and Northern Ireland (the full title is Stamp Duty Land Tax. (SDLT))

In Wales it’s called Land Transaction Tax (LTT) For completeness in Scotland it goes by the name of Land and Buildings Transaction Tax (LBTT) with Additional Dwelling Supplement (ADS).

2. LTT Rates

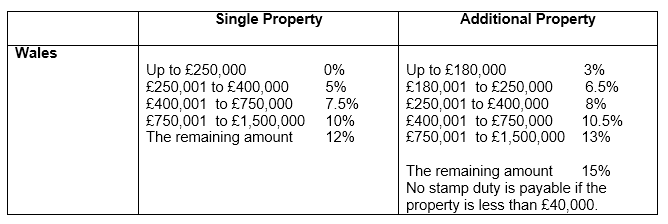

The current LTT rates have been temporarily reduced until 31 March 2021, the so called Stamp Duty Holiday. Therefore the current LTT rates to 31 March 2021 are as follows, depending on whether it is a single or additional Property:

3. How do LTT rates in Wales compare to rates in England/NI and Scotland?

We thought the best way to analyse the rates would be to see how much LTT you would actually pay for the same price points compared to stamp duty in the rest of the UK. Please see below:

What we can ascertain from this table is that in terms of LTT, the stamp duty a buyer would pay is a lot more than if buying the same priced property in England and Northern Ireland. But generally speaking it is cheaper than in Scotland.

Most properties are less than £500,000 rather than above this figure. If you buy a family home in Wales at £500,000 in Wales, you would pay £15,000 in LTT. But if you bought one at the same price in England or NI you would pay nothing. It seems Wales may be getting a raw deal here, notwithstanding the fact that properties on average cost more in England. The only comfort I suppose is that Wales in cheaper than Scotland. For the same price, buyers in Scotland would pay £21,250.

Where the differences are very apparent is if you buy a second property. And additional property in England at £500,000 would create a £15,000 tax bill. But in Wales it would be a whopping £32,450

Comments